Interview This Week? Be Ready Tonight.

Walk into your interview knowing exactly what to say. Practice real questions, get instant feedback, and feel confident instead of nervous.

4.9/5 from 2,000+ users

Go From Nervous to Confident in One Evening

Three simple steps. Real results before your interview.

Never Get Caught Off Guard

Tell us your target role and we'll show you the exact questions you're likely to face. No more guessing what they'll ask.

Practice Like It's the Real Thing

Answer questions by speaking aloud or typing, just like your actual interview. Practice 10 questions tonight and feel the difference tomorrow.

Know Exactly What to Improve

Get instant, detailed feedback on every answer. No vague tips, just actionable insights on clarity, structure, and impact so you can improve before your interview.

From Anxious to Confident. And Hired.

Join thousands who walked into their interviews feeling prepared, not panicked.

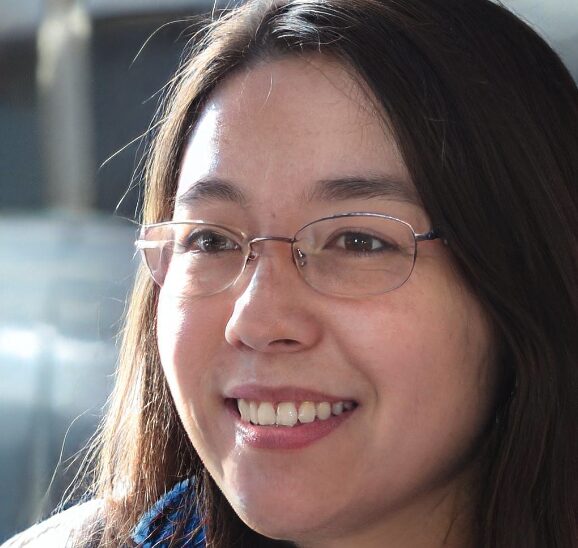

Before this I wasn’t sure what I was doing wrong. After just a few tries I knew exactly how to improve and I actually felt confident walking into my next interview.

Sophia B.

Product Manager

This gave me the kind of feedback I wish I’d had years ago. It showed me what I was doing well and where I was losing people. No fluff, just really helpful advice.

Andy B.

Finance Director

Practicing with friends was awkward. This let me prep on my own terms and it actually pointed out mistakes I didn’t even realize I was making. I got interviews fast.

Robin T.

Marketing Graduate

I didn’t think an AI tool could really help but it was surprisingly sharp. It caught habits I’ve had for years. Honestly, it changed the way I show up in interviews.

Emily W.

Clinical Scientist

Trusted by candidates from leading companies

Know Exactly What Hiring Managers Want to Hear

Stop guessing what makes a great answer. This 9-part guide shows you exactly how to impress at every stage, from first impression to final offer.

Get a comprehensive overview of what hiring managers are looking for and set yourself up for success from day one.

Learn the most efficient way to research companies and develop the right mindset to impress interviewers.

Use our battle-tested frameworks to craft compelling stories and stand out from other candidates.

Develop a compelling elevator pitch that showcases your unique value as a professional in under a minute.

Got Questions? We've Got Answers

Everything you need to know before you start preparing.